As we sit almost five months into 2024 in the middle of the spring market and I reflect on how the year is going, I am grateful, amazed, and locked in on the stats. You see, the last four years since the start of the pandemic have been an eventful and wild ride. 2020 saw a brief halt in sales when the shelter-in-place order went into effect, and once protocols were established to make real estate essential, the market started to take off. Many people utilized that time to re-evaluate where they wanted to live, whether that meant in a different state, from an urban location to a rural setting, or from a shared condo building to a single-family residential house.

This re-organization of where people wanted to live was coupled with historically low interest rates that hovered in the 3% range, leading to the highest number of recorded closed sales in 2020 and 2021 that we had seen in over a decade. All of this activity took place while inflation was on a stubborn uphill trajectory, causing the Fed to make some big rate increases to help combat consumer spending in 2022.

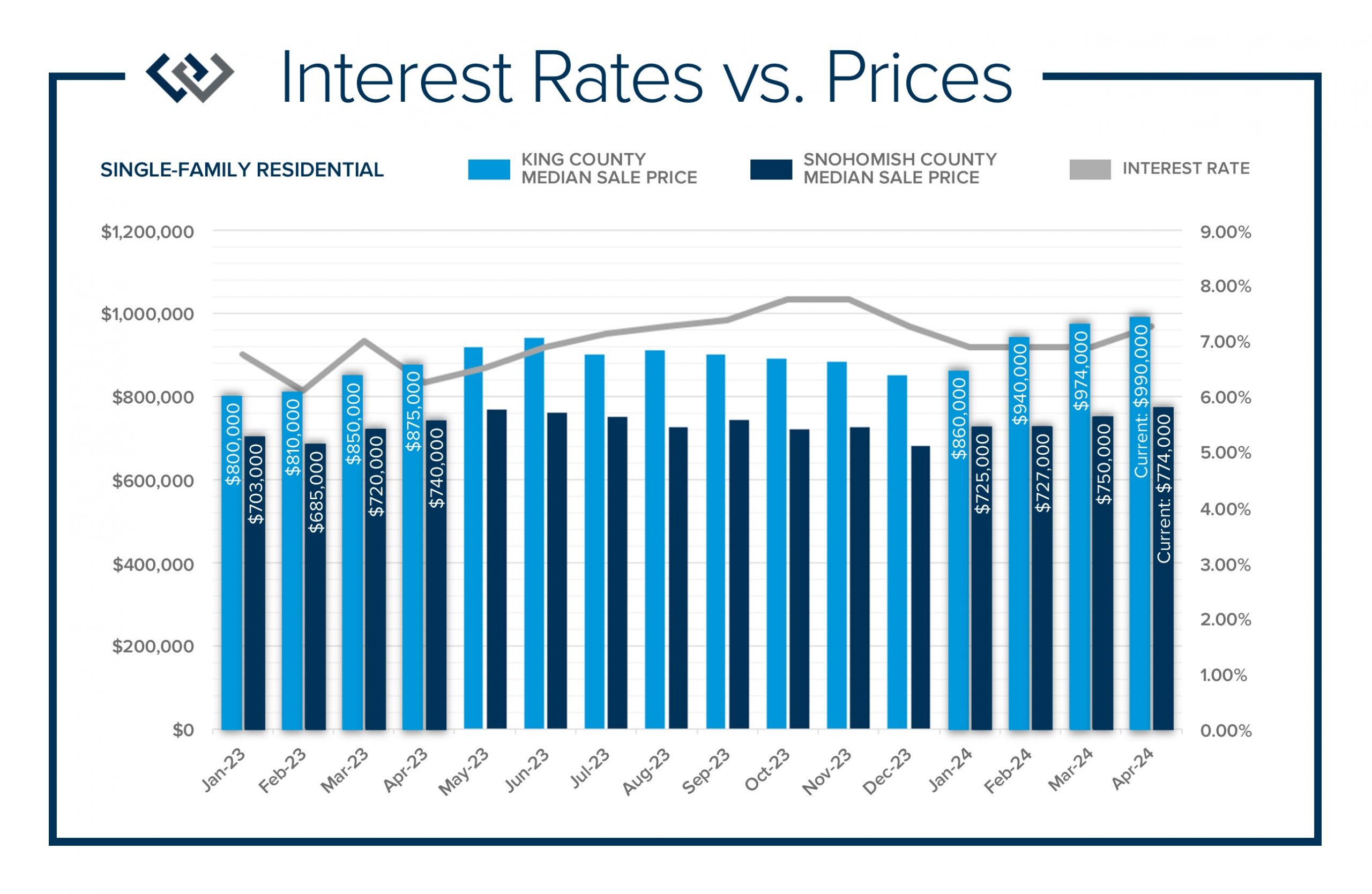

Rates increased by three percentage points from February 2022 (3.9%) to October 2022 (7%) and have remained in that higher range ever since. This quickly put a stall on buyer demand as monthly payments quickly became more expensive, putting downward pressure on affordability. This caused a correction in prices from the peak in spring 2022 to the first quarter of 2023 when prices bottomed out.

In King County, prices corrected from the peak to the bottom by 20%, and in Snohomish County, 17%. Prices started to bounce back from the bottoming out in the spring of 2023, and since then have increased 24% in King County and 13% in Snohomish County. While prices were stabilizing and then growing from Q1 2023 until now, interest rates have hovered in the 7% range. Buyer demand slowly regained its footing throughout 2023 and when the calendar turned to 2024, buyers started to come out in force despite the interest rates never returning to historic lows. It is safe to say that many buyers have accepted the higher interest rates as the new normal.

In this new normal, monthly payments are high as prices remain stable and have had extreme appreciation since the start of 2024. In King County, prices have grown by 16% from Dec 2023 to April 2024 and in Snohomish County by 14%. At the end of 2023, it was reported that the average homeowner had at least 60% home equity in King County and 57.5% in Snohomish County. That equity measurement doesn’t include the price growth we have experienced so far in 2024.

Rates have remained stubborn due to inflation still being a challenge. Inflation has tempered, but not to the 2% year-over-year level the Fed wants to see before easing interest rates. The Fed met at the beginning of May and indicated that rates will slowly come down in the second half of 2024 and into 2025 if inflation rates reach that 2% year-over-year mark. That will be a key marker to track as the Fed Chairman, Jerome Powell has made it clear that will be what it takes to cause rate relief.

Some buyers may wait to enter the market once rates have eased, and many are jumping in now as they are happy to secure today’s prices. Demand will only increase when rates improve, which should most likely cause additional price growth. Creative financing options such as interest rate buy-downs and ARM (Adjustable-Rate Mortgage) loans have helped buyers manage their monthly payments when making a purchase. The key factor I help the buyers I serve stay focused on, is the affordability of their monthly payments.

This focus has proven to be the most productive and strategic number to stay connected with to help a buyer remain confident and effective. Buyers often make adjustments in price point, features, and/or location to match up a manageable monthly payment with the home they buy. Analyzing the trends, stats, and values from one area to the next is an exercise that helps buyers gain clarity. We often say that when a buyer finds a home that matches 75-85% of their criteria they are in striking distance to make an offer. In a seller’s market like this, buyers must make compromises to succeed.

A bright light for buyers is that we have seen a recent jump in new listings. There were 30% more new listings in April 2024 over April 2023 in King County and 32% more in Snohomish County. With seller equity so high and pent-up seller motivation boiling over, we are finally starting to see additional inventory come to market. We are still experiencing tight inventory, but it is growing. This is providing some additional selection and should hopefully continue throughout 2024.

Continuing my daily, weekly, monthly, and annual commitment to studying the market is a benefit to the clients I serve. Understanding how inventory, rates, and prices all relate to each other helps me provide valuable insights for clients so they can appropriately strategize when they want to enter the market. These trends vary from one city to the next, in different price points and property types. If you are curious about how today’s trends relate to your real estate goals, please reach out. Further, if you know someone who needs my assistance, please direct them my way. It is my goal to help keep my clients well-informed to empower strong decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link